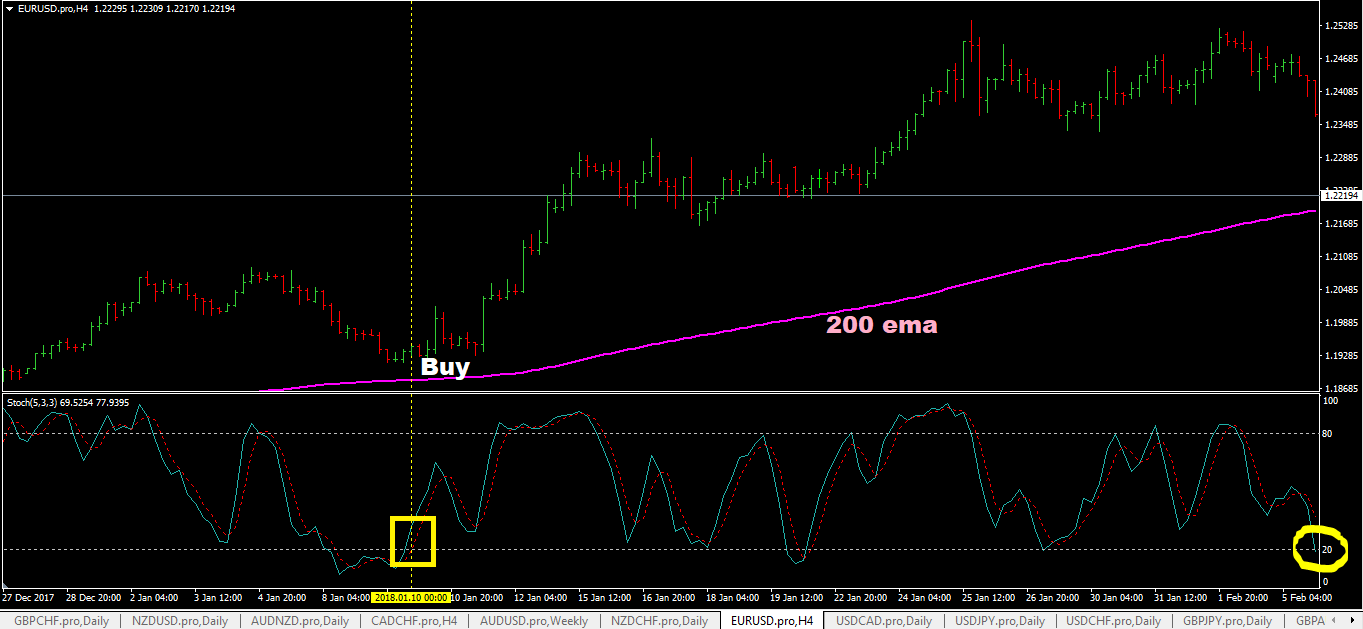

Of course, there is a slight delay, so I can use it in shorter time frame or use the cross of EMA 20 with higher EMAs to enter or exit earlier.īut consider this point, for example, in the image below, as long as EMA50 does not have crosses with 100 or 200, we can not be sure of a change in market trends, and we see that most returns are actually pullbacks to higher EMAs that act as resistance, and we can even do it again.

For example, I usually get very valid signals from it in 4-hour timeframe, I get signal with cross of 50EMA with 100 or with EMA200 cross signals. 100 ema crossover, Technical Analysis Scanner 100 ema crossover New: LIVE Alerts now available Scanner Guide Scan Examples Feedback Scan Description: Above buy at bullish signals Stock passes all of the below filters in futures segment: Latest Close Crossed above Latest Ema ( close,100 ) Latest Close Greater than Latest Open Running.

#100 and 200 ema crossover series

When your alert triggers you will receive a notification via push notification, email, phone call, or text message.In this indicator, I have considered all crosses for the EMA of 20, 50, 100 and 200 and 1 optional ema(7).Īlthough the EMAs indicator is very old and sometimes has a lag, but sometimes we have seen exactly a heavy purchase and sharp move happened by the crossover or huge sell and fall by crossunder at the same time, and this shows that institutions and hedge funds use it yet, it is not obsolete yet, so it can still be used well.Īs you may know, to use it, you have to be able to consider a series of settings. With Stock Alarm you can set EMA alerts on stocks, etfs, crypto, indices, commodities, and more. Finally, the last graph below shows that the 5-10-20 strategy (red) has been much more effective than the classic 50/200-day EMA crossover approach (blue) on this particular index. A X-Day EMA Target alert can help you catch those kinds of Keep in mind that the 50-day,100 day, 200-day Simple Moving Average crossover is a very long-term strategy. Stocks moving above their 5-Day Moving Averages have shown consistentīullish action throughout the last X days of movements on the stockĮxchange. 20 50 100 200 above crossover ema LIVE Alerts Stock passes all of the below filters in cash segment: Latest Close Crossed above Latest Ema ( close,20 ) Latest Close Crossed above Latest Ema ( close,50 ) Latest Close Crossed above Latest Ema ( close,100 ) Latest Close Crossed above Latest Ema ( close,200 ) Running. Stock Alarm currently supports EMAs with the following periods: 5 Day, 10 Day, 20 Day, 30 Day, 50 Day, 100 Day, and 200 Day.Įstablish the General Trend of the Stock: When the stock is above its X-Day EMA, it is considered to be “in strength.” Level, this could be interpreted as evidence that support is holding.ĮMA Price Cross alerts allow you to monitor when the exponential moving average of a certain stock crosses above or below the current price of the stock. Conversely, the Death Cross signifies a condition when the market is once again dominated by bears, visualized by the medium-term average crossing below the 200. Just set theĮMA Target at the price of support, and once the stock climbs above this Let’s assume over the last 5 days, Apple shares closed at 100, 90, 95, 105, and 100. We can use it to confirm an important support level is being held. Scan Description: Bullish Ema Crossover Scan.

Stock Alarm currently supports EMAs with the following periods: 5 Day, 10 Day, 20 Day, 30 Day, 50 Day, 100 Day, and 200 Day.Ĭonfirm Support Buys in Channels and Trends: Much like we can use this EMA Target alert to confirm a breakout position, Ema Crossover (20, 50, 100, 200) New: LIVE Alerts now available Scanner Guide Scan Examples Feedback. The exponential moving average (EMA) is a type of moving average that places a greater weight on recent price data.ĮMA Target alerts allow you to monitor when the exponential moving average of a certain stock crosses above or below a target value. The period that the EMA represents isĭirectly correlated to which time frame the moving average is best suited for. Support or resistance for a moving stock. Tool used to gauge the strength and direction of trends and to act as potential The Exponential Moving Average is a common technical analysis Add up the closing price of NIFTY for 100 days including today. It may also be helpful to read our article on a stock's EMA to gain more context before reading the following: Click Here Crossover of Ema 20 and Ema 200 is important here.

0 kommentar(er)

0 kommentar(er)